BitMEX Review: Can You Really Trust This Crypto Exchange?

A perpetual contract allows you to trade on approximately the same reference index price of the underlying assets as that is used in spot markets. What is more, BitMEX allows you to practice using BitMEX TestNet that’s created especially for learning purposes. Users can practice margin trading with leverage completely risk-free as well as try other amazing features that the platform offers. Also, BitMEX fees are very low, so it’s definitely recommended for those who are into daily trading. As already mentioned, BitMEX doesn’t accept fiat currencies, so it might be a bit difficult to make deposits for those of you who haven’t done it before.

The BitMEX team continues to innovate with robust trading engine security and new perpetual swaps. BitMEX operates multi-signature wallets, holds all funds in cold storage, and at least two employees audit all withdrawals. BitMEX claims that the MPC prevents an attacker from stealing funds even if all of BitMEX’s systems are compromised. This may involve a manual review of your withdrawal attempt to ensure that withdrawals are legitimate. Yes, BitMEX is a well-respected exchange and it uses a secure multi-party computation (MPC) system and a first-of-its kind multisignature deposit and withdrawal scheme.

Best Crypto Derivatives Exchanges For Futures Trading – 2023

With Convert, users can change Bitcoin and Ether into Tether and vice versa, with more coin conversions to be introduced soon. It has zero fees, gives the user a free quote before executing the conversion, and the transaction occurs immediately. With Future Contracts, once the contract settles, any users who have a position are settled at the settlement price of the contract itself. Bitmex allows traders to long or short Futures and Perpetual Contracts by selling or purchasing them.

- Having said that, it is only a matter of time before it becomes impossible for US-based traders to use it on an ongoing basis.

- However, margin trading with leverage, futures contracts, perpetual futures, and other processes can be quite difficult to grasp and quite risky for users who haven’t done this before.

- As noted earlier, the entire BitMEX platform operates on Bitcoin, meaning that you can only deposit and withdraw BTC.

- Simply put, BitMEX is an exchange that combines margin trading and derivates of crypto assets for cryptocurrency traders.

BitMEX allows users to trade a number of different cryptocurrencies, namely Bitcoin, Bitcoin Cash, Dash, Ethereum, Ethereum Classic, Litecoin, Monero, Ripple, Tezos and Zcash. To summarize, you can trade with BitMEX for large daily volumes of derivatives exchange. BitMEX also integrates other trading products into the Futures Contracts.

Opening a BitMEX Account

However, it should be noted that BitMEX does not accept any US-based traders and will use IP checks to verify that users are not in the US. People will visit BitMEX and use this exchange platform extensively for trading derivatives of the largest cryptocurrency – Bitcoin. This app also helps in speculating the market to bitfinex exchange review earn Bitcoin profits assuredly. In traditional and cryptocurrency markets, unprecedented volatility creates a stir among traders. These responsive charts help traders leverage the power of advanced trading tools. It can maximize profits and minimize risk when used under the required time frames and market indicators.

Bitmex is ideal for experienced crypto traders who only want to use Bitcoin and a limited number of cryptocurrencies. It offers plenty of advanced trading features that are perfect for those who want more granular control. Plus, users have access to innovative features, a responsive customer service team, and fees that are comparable to the rest of the crypto market. Users can also use the platform’s native BNB token for even cheaper trading fees.

Trading Fees

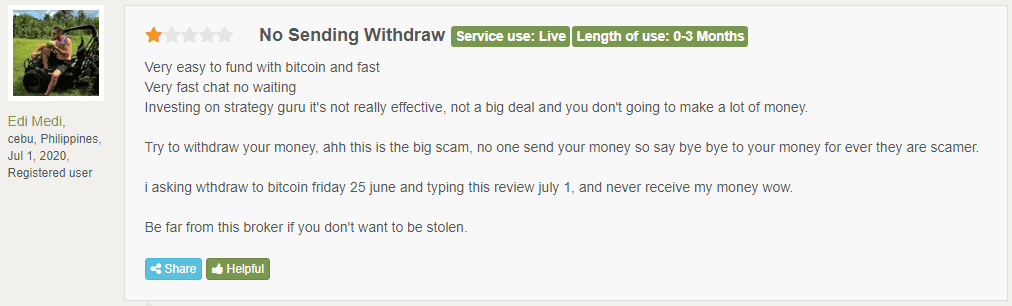

This is a drawback for users engaged in margin trading, or 100x leverage trading, etc., as the long waiting period can result in huge losses for them. As the number of BitMEX users has increased, user complaints have increased accordingly. Several users complain of market manipulation, problems withdrawing assets, and a complicated user experience. Although the customer support is there to clear out any query or misunderstanding, the exchange has faced numerous charges that have been accused of market manipulation, etc. As such, we can’t recommend BitMEX to users aiming to trade multiple altcoins. That said, the cryptocurrency exchange is primarily a Bitcoin and derivatives trading platform, and the coins offered by BITMEX are some of the most popular coins for trading with leverage.

The signup process is relatively straightforward and you will only be required to provide an email. In the case of hidden orders (more below) the fees that you will encounter differ slightly. When you place your hidden order, you will pay the taker fee until the complete order is done. Then, once it has been executed, you will be given the maker rebate. They also use an external service to verify that all deposit addresses that are created on the system are those that are controlled by the founders. The mobile version is available to download from the official website.

Our New Crypto Derivative

BitMEX is clearly not a platform that is not intended for the amateur investor. The interface is complex and therefore it can be very difficult for users to get used to the platform and to even navigate the website. In addition, BitMEX provides a variety of educational resources including an FAQ section, Futures guides, Perpetual Contracts guides, and further resources in the “References” account tab. HDR Global Trading, the company which owns BitMEX, has recently announced a partnership with Trading Technologies International, Inc. (TT), a leading international high-performance trading software provider. Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left. The order book shows three columns – the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long.

- On the other hand, the Bybit exchange is a new platform that has over 100,000 traders in a short time.

- The Place Order box is where you can trade cryptocurrencies on BitMEX.

- For those looking for a more simple exchange to buy and sell some Bitcoin, I suggest you look into some other more user-friendly options.

- It is safe to say that this exchange enables advanced trading techniques for its users.

- BitMEX is a professional cryptocurrency derivatives exchange that offers up to 100x leverage and supports trading for cryptocurrencies.

There are no further account tiers at BitMEX, as KYC’d users have full access to exchange services. BitMEX states they do not accept US traders in their terms of service. BitMEX recently updated their terms and conditions so they require all customers to provide photo ID, proof of address and selfie. The exchange doesn’t limit access for any locations, due to the fact that it does not handle fiat currency deposits or trading pairs. Local laws may affect your use of the service, however this is out of the exchange’s control.

It was when I filed a complaint against them at highforest capitalltd (.com) that I confirmed its all a scam. HFCL was good enough to help trace my funds and recoup all of my funds to me. Plus, there have been no major talks on public forums about its hack or inconsistencies yet. And that’s because very few people know how to margin trade cryptocurrencies and not many reviews are available for the same. BitMEX is open for all customers and traders worldwide, except the United States.

BitMEX Review [2020 Edition] Leverage Bitcoin & Altcoin Trading – Blokt

BitMEX Review [2020 Edition] Leverage Bitcoin & Altcoin Trading.

Posted: Sat, 04 Apr 2020 07:00:00 GMT [source]

For spot, the maker and taker fees are set at 0.1% and for derivates, the maker rebate is 0.01% and the taker fee is 0.075%. However, it is important to remember that should BitMEX one day cease to exist, you will effectively have no one to turn to. In layman terms, this means that if you only had the Bitcoin equivalent of $100 in your account, you could effectively trade with a $10,000 bankroll. However, it is reasonable to suggest that trading at a level of 100x is no different to rolling the dice in a casino.