Banking CBSE Notes for Class 12 Macro Economics

Contents:

In 2012, European Central Bank President Mario Draghi said that the bank will do “whatever it takes” to save the euro. These remarks bolstered the battered currency and helped its subsequent recovery. Next part, we shall see the limitations of monetary policy. SLRrefers to a certain percentage of reserves to be maintained in the form of gold and foreign securities. I get to understand the economy for the first time since I started my preparation….

So Madam cannot USE those government securities to borrow under Repo Rate from Rajan. What if Rajan subsequently sells those (Mohan’s) securities to bankers. Whenever Rajan buys veggies and pays – the money supply is increased.

Quantitative and Qualitative Instruments of Monetary Policy

The minutes of a central bank’s monetary policy review meeting, for example, can be worded in such a manner as to indicate such a reality. Journalists and analysts then dissect it and relay the sentiments to the market. The oligopolistic competition in the British banking sector has witnessed the success of moral suasion as a monetary policy instrument, which allows the central bank to control by persuasion and directive. The creation of credit or deposits is one of the most important functions of commercial banks. Credit creation is a process in which expansion of bank deposits takes place along with the investments in the form of loans and advances. Like other companies, the banks also aim at earning profits.

- By changing the ratio of these reserves, RBI can control the credit power of banks.

- Thus, moral suasion relies on verbal techniques rather than the use of force or coercion to get people to act in a certain manner.

- The only criticism of moral suasion is that it is not backed up by legal consequences or force of law.

- In early educational thought, it was often paired against corporal punishment as a means of achieving school discipline.

- Journalists and analysts then dissect it and relay the sentiments to the market.

In the U.S., https://1investing.in/ is also known as “jawboning,” since it amounts to talk, in contrast to more forceful methods the Federal Reserve and other policymakers have at their disposal. More specifically, attempts by central banks to influence the rate of inflation without resorting to open market operations are sometimes called “open mouth operations.” The moral suasion is a more lenient method than other forms of selective credit control methods as it does not involve any punitive action or administration threat. Thus, it helps the central bank to gain the willing cooperation of the commercial banks. The moral suasion proves to be effective only when the central bank gets a full cooperation and respect for its directives from the commercial banks. Moral Suasion is a request by the RBI to the commercial banks to take specific measures as per the economy’s trends.

• In a situation of excess demand leading to inflation, the central bank introduces rationing of credit in order to prevent excessive flow of credit, particularly for speculative activities. • It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves. But the banks cannot use the whole of deposit for this purpose.

The Yes Bank Crisis

Thus, moral suasion relies on verbal techniques rather than the use of force or coercion to get people to act in a certain manner. In economics, the term is used with respect to the activities of central banks. With traditional monetary policy tools more difficult to employ, the Fed has attempted to convince markets of its willingness to support a sustained economic recovery through words rather than deeds, when possible. Moral suasion may be used both publicly and privately. Fed chair Alan Greenspan’s 1996 criticism of the prevailing economic mood as “irrational exuberance” is a classic example.

Broad money refers to the money held by the public in the form of savings and Net Time Deposits apart from the currency and demand deposits. The high powered money refers to that money which is held by the public, demand deposits of banks and other deposits held by the Reserve Bank of India. Price to free cash flow is an equity valuation tool that compares a company’s market price per share to its free cash flow per share .

This is the environment that existed from December 2008 to December 2015. The size of the government’s balance sheet grows as a result of expansionary policies. Therefore, acquiring additional government debt becomes increasingly difficult. At the time of higher inflation in the country, RBI increases the reverse repo rate that encourages banks to park more funds with the RBI, which will help it earn higher returns on excess funds. Government securities and bonds from commercial bank.

The orders do not have any effect on that care, except perhaps by moral suasion or implication, without any force of law. I have persuaded hundreds of my friends and fellow trade unionists to join the movement, not by using coercion but by using moral suasion. The third role is that of exhortation and the use of moral suasion to convince companies to engage in cooperation. Get ready with Test&Train , the online practice tool from Cambridge. Build your confidence with hundreds of exam questions with hints, tips and instant feedback. In a series of sharing useful study material for upcoming banking exams.

Primary Sidebar

ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. “Impure” moral suasion is often referred to as “moral suasion” in economics. It is supported by explicit or implicit threats by authorities to provide incentives to adhere to the authorities’ commands. It issues special bulletins on various issues like supply of finance, financial matters of both Central and State Governments. Explain the qualitative or selective methods of credit control.

This metric is very similar to the price to cash flow valuation metric, but it is considered a more precise measure. This is because it uses free cash flow, which subtracts capital expenditures from a company’s total operating cash flow. As a result, it reflects the actual cash flow available to fund non-asset-related growth.

Fed’s Moves in the Minutes – Investopedia

Fed’s Moves in the Minutes.

Posted: Thu, 26 May 2022 07:00:00 GMT [source]

With the purchase of these securities, the power of commercial bank of giving loans increases, which will control deficient demand. • In other words, in case the commercial banks fail to meet their financial requirements from other sources, they can, as a last resort, approach to the central bank for loans and advances. Moral suasion is an appeal to morality, in order to influence or change behavior. A famous example is the attempt by William Lloyd Garrison and his American Anti-Slavery Society to end slavery in the United States by using moral suasion. Moral suasion in this narrower sense is also sometimes known as jawboning.

Moral Suasion vs Suasion

In a situation where a moral suasion meaning in banking finds itself unable to enact a certain policy measure or prefers not to take explicit action, it may resort to suasion. A liquidity trap can occur when consumers and investors hoard cash and refuse to spend even when economic policymakers cut interest rates to stimulate economic growth. Rather than directly injecting public money, the New York Fed called a meeting in its offices of three banks that had lent to LTCM. These banks decided to cooperate on a rescue, which the Fed helped coordinate but did not fund. Eventually, a consortium of 14 banks bailed LTCM out for $3.6 billion.

This helps in lowering the bank’s credit exposure to unwanted sectors. This instrument also controls the bill rediscounting. Sometimes, the RBI borrows money from commercial banks when there is excess liquidity in the market. In that case, commercial banks get benefits by receiving the interest on their holdings with the RBI.

The commercial banks have to keep a certain amount of reserve assets in the form of reserve cash. Some portion of these cash reserves is their total assets in the form of cash. Commercial banks also increase their lending rate to the public and business enterprises so that people borrow less money, which will eventually help to control inflation. Suppose Vijay Mallay got 100 crore loan from State Bank of India. If you trace the ‘source’ of that money, it’ll turnout crores came from bank’s savings account, fixed deposit etc. Rajan lends money in repo rate –yes, but that doesn’t mean banks depend only on Rajan to arrange the cash for its clients.

They put all their strength into moral suasion, and did not think that any moral value would come from such restrictions as these. Moreover, we are not in reality doing this thing by moral suasion. I hope that moral suasion will bring common sense to some of the activities taking place.

Final Basel III to Have Muted Impact on Most Asia-Pacific Banks – Fitch Ratings

Final Basel III to Have Muted Impact on Most Asia-Pacific Banks.

Posted: Wed, 14 Sep 2022 07:00:00 GMT [source]

Monetary policy to a great extent is the management of expectations, influencing inflation expectations of business and labour. First, citizens must support the government’s policy, thus entailing objective congruence between the promoter of moral suasion and the target whose behaviour should be changed. The business community felt that the rules that were enforced through moral suasion not to be just and moral. Thus, factors that determine compliance are the government’s objectives, the cost of noncompliance, and whether social reputation suffers if noncomplance is known about.

On the other hand, qualitative tools like moral suasion, credit rationing, and direct controls are more indirect and non-monetary in nature. These tools aim to influence the behavior of banks and other financial institutions to achieve desired economic outcomes. On the other hand, when RBI reduces bank rates, that means borrowing for commercial banks will become cheap and easier. This allows the commercial banks to lend money to borrowers on a lower lending rate, which will further encourage borrowers and businessmen.

- Price to free cash flow is an equity valuation tool that compares a company’s market price per share to its free cash flow per share .

- Currency notes issued by the central bank are the legal tender money.

- Can increase or decrease liquidity in the economy to control money supply.

- The demand for money to meet the unforeseen and unexpected expenses is known as precautionary demand for money.

- No matter what number juggling or statistical interpretations are given- the hardship of common man has not stopped- be it milk, petrol, onion, LPG anything.

For instance, RBI may direct banks not to give out certain loans. It includes psychological means and informal means of selective credit control. If RBI sells securities in the money market, private and commercial banks and even individuals buy it. This leads to a reduction in the existing money supply as money gets transferred from commercial banks to the RBI. On the other hand, when RBI buys securities from the commercial banks, the commercial banks that sell receive the amount they had invested in RBI before. In the Indian Economy, RBI is the sole authority that decides the money supply in the economy.

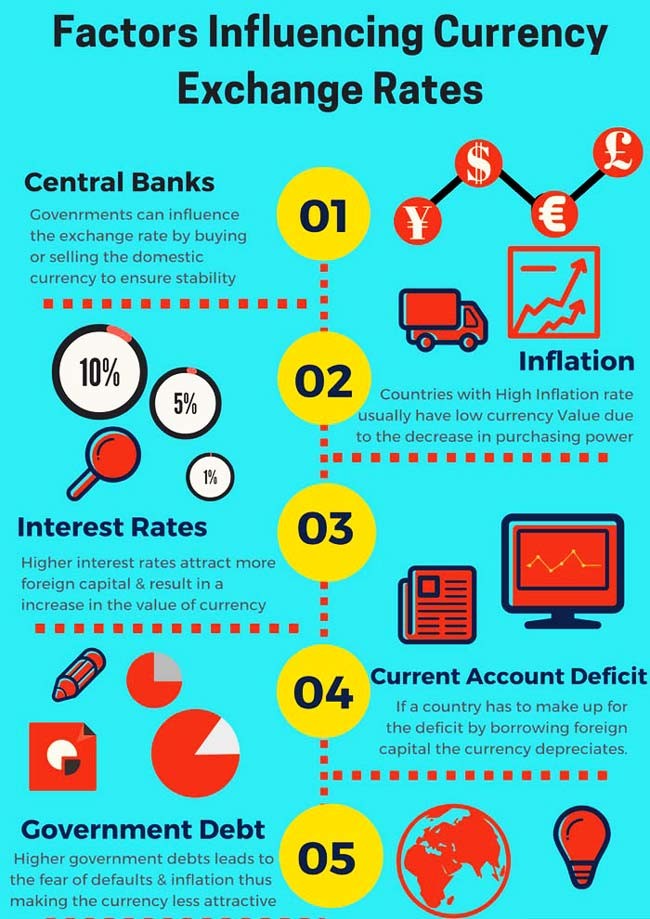

And to control this, RBI implements the monetary policy’s Quantitative and Qualitative instruments to achieve economic goals. The main instruments of these policies are CRR, SLR, Bank Rate, Repo Rate, Reverse Repo Rate, Open Market Operations, etc. • In a situation of excess demand leading to inflation, central bank raises marginal requirements. This discourages borrowing because it makes people gets less credit against their securities. Moral suasion is a request by the RBI to the commercial banks to take specific measures as per the economy’s trends.

In order to save Yes Bank from collapsing and to preserve people’s trust in the Indian banking system, RBI has taken several measures. In this instrument, consumers’ credit supply is regulated through the instalment of sale and hire purchase of consumer goods. Here, features like instalment amount, down payment, loan duration, etc., are all fixed in advance, which helps to check the credit and inflation in the country. The sale and purchase of security in the long run/short run by the RBI in the money market is known as open market operations. This is a popular instrument of the RBI’s monetary policy.

My Say: A look at pegging the currency and managed floats – The Edge Markets MY

My Say: A look at pegging the currency and managed floats.

Posted: Thu, 07 Jul 2022 07:00:00 GMT [source]

• In a situation of excess demand leading to inflation, it appeals for credit contraction. The central bank has the sole monopoly to issue currency notes. Currency notes issued by the central bank are the legal tender money. Central banks and governments that let markets know what they consider ranges of “appropriate” values for its currency impact the trading of the currency, even if intervention never occurs.